Before we wrap up 2017, we at Texas Final Drive wanted to let you know (or to remind you, if you already knew!) about something that will save you a lot of money if you’re looking to purchase new or used equipment before the end of the year. Yes, this includes final drives!

What is Section 179, and How Does it Help?

Section 179 is a tax deduction that you can claim when you file for your annual tax return. It states that you can deduct up to $510,000 (for 2017) from your taxes on all purchases of new or used equipment!

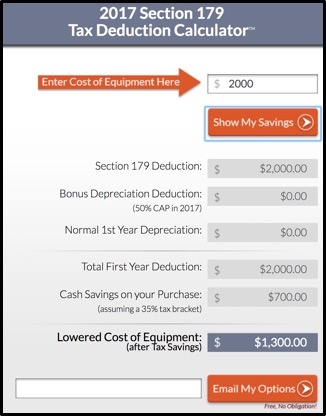

For example, if you purchase a final drive now for $2000, you can claim a deduction of $700 -- assuming that you have a 35% tax rate. This is a small business incentive that works for you.

See how much you could save by typing in the cost of your equipment to the official Section 179 calculator.

It’s important to note that in order to claim this deduction when you file taxes in 2018:

- You must have purchased or financed the equipment and put it into service by the end of day on December 31st, 2017.

- There is a $2,000,000 spending cap on equipment purchases, making this a true small business incentive.

Did you know about this tax deduction? Now you do! Learn more about it at their official website, and get spending (and saving)!

Texas Final Drive is your partner in providing new or remanufactured final drive hydraulic motors from a single mini-excavator to a fleet of heavy equipment. Call today so we can find the right final drive or hydraulic component for you, or check out our online store to find your O.E.M. manufacturer brand motor now.